COVID-19 Resources

Coronavirus InfoAHLA Resources Centers for Disease Control and Prevention Explore Georgia Georgia Department of Economic Development Georgia Department of Public Health

Frequently Asked QuestionsAs we face a fluid situation with new information learned daily, AHLA has now assembled a one web page to address Frequently Asked Questions in the areas of Advocacy, Legal & Human Resources, and Operations. Check back for continuous updates.

Small Business Relief & ResourcesAs part of the CARES Act, the Small Business Administration is providing financial assistance through two main programs listed below.

Employment Opportunities & ResourcesThe AHLA Foundation, through the Hospitality for Hope initiative, is extending the following resources to hospitality professionals:

|

WebinarsStay up to date on the many webinars brought to you by our national association partners.

Safe Stay

“Safe Stay” is AHLA's initiative focused on enhanced hotel cleaning practices, social interactions, and workplace protocols to meet the new health and safety challenges and expectations presented by COVID-19.

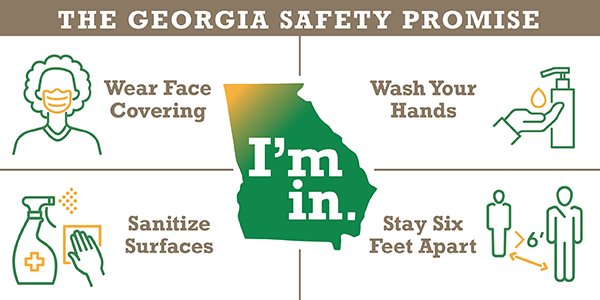

Georgia Safety PromiseWhat is the Georgia Safety Promise? It’s a statewide campaign from the Governor’s Office and the Georgia Department of Health that encourages businesses and the public to agree to simple, but critical, measures that will keep Georgians safe from COVID-19, minimize spread of the virus, and keep Georgia open for business.

By committing to the Georgia Safety Promise, you are making the decision to take steps to keep yourself safe and protect others during COVID-19. And when you make the promise, you’ll have access to materials so you can share your commitment with your customers, friends, and family. Commit to the promise below. STR ResourcesSTR has partnered with GHLA to offer a complimentary Hotel Survey program to benchmark your property’s performance (Occupancy, Average Daily Rate, & Revenue Per Available Room) to your market on a monthly basis. This program is open to properties not currently participating in STR STAR reporting to better help you understand the impact on your hotel and respective market. Sign up here. Even if a property is temporarily closed, you may still participate. Click here to view answers to frequently asked questions.

Call to Action

|

State Legislative & Regulatory Updates

US Legislative & Regulatory Updates

|

Press Releases & Additional Resources

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (01/31/2021)

- AHLA Unveils State of Industry 2021 Report

AHLA released its inaugural State of the Hotel Industry 2021 report, which examines the high-level economics of the hotel industry's recovery, the impact on and eventual return of business travel, and consumer travel sentiments.

Key findings in the report include:

• Half of U.S. hotel rooms projected to remain empty;

• Leisure and hospitality sector ended 2019 down

4 million jobs:

• Hotels to add 200,000 direct jobs, but remain

500,000 below 2019 levels;

• Business travel expected down 85% through April;

• 56% of consumers expect to travel for leisure;

• Nearly half of consumers see vaccine distribution

as key to travel.

Click here to download a PDF of the report. - Georgia COVID-19 Vaccination Update Georgia is currently vaccinating individuals in Phase 1A+ of the Georgia Vaccine Plan, which includes all healthcare workers (clinical and non-clinical individuals who may be exposed to infectious patients or materials), long-term care facility residents and staff, urgent care facility staff, law enforcement, EMS, fire personnel, dispatchers, 9-1-1 operators, and adults over 65 and their caregivers. The Georgia Department of Public Health (DPH) has created a COVID-19 Vaccine Partner Toolkit and offered it to GHLA members. This link will provide you with a zipped downloadable file that contains posters, a fact sheet, FAQs, CDC stickers, the vaccine distribution infographic, and presentation materials. You can also find the latest version of the Georgia Vaccine Plan and detailed vaccine safety information on the DPH website. DPH will continue to update its toolkit, and this webpage as more materials are developed and more data becomes available. (1/20/2021)

- SBA Releases Additional Guidelines Regarding PPP The Small Business Administration (SBA), in consultation with the Treasury Department, has released additional guidance on how to calculate revenue reduction and maximum loan amounts for the Paycheck Protection Program (PPP).As of January 17, SBA had approved approximately 66,000 PPP loans, and it is now accepting applications from all lenders. Hoteliers interested in obtaining a first or second draw loan are encouraged to begin working with their lenders and filling out their applications (loan details and applications available here). SBA's announcement on the finalized rollout schedule is available here. (1/17/2021)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (01/15/2021)

- Hilton Alpharetta Atlanta Upcoming Job Fair: The Hilton Alpharetta Atlanta is hiring and invite all to attend their upcoming job fair. Details are listed below:

- Date & Time: January 20, 2021 from 10am until 12pm

- Location: The Commons at Phase: 12150 Morris Rd. Alpharetta, GA 30005

- EEOC Guidelines on Vaccinations The Equal Employment Opportunity Commission (EEOC), which enforces workplace anti-discrimination laws, has released guidance on vaccinations for employers and employees. The guidance, in the form a continually updated FAQ, covers numerous laws and regulations that the EEOC has jurisdiction over. It is important that employers review this guidance as vaccinations become more available to the general public. We urge you to work with your counsel to ensure you are in compliance with the EEOC and other regulatory bodies. AHLA will continue to monitor the EEOC's activities and ensure the hotel industry's perspective is taken into account for any future guidance.

- President Donald Trump signed the coronavirus stimulus package and the annual spending bill into law, avoiding a looming government shutdown and securing relief for those most impacted by the COVID-19 pandemic. A copy of the bill can be found here H.R. 133, Omnibus Appropriations and Emergency Coronavirus Relief Act and a comparison to the CARES Act can be found here - COVID Relief Bills Comparison (12/27/2020)

- H.R. 133, Omnibus Appropriations and Emergency Coronavirus Relief Act passed late last night by an overwhelming majority in both chambers. President Trump is expected to sign the legislation. This short-term relief package is a vital step toward helping the hotel industry survive this ongoing crisis. (12/21/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (11/30/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (10/30/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (10/30/2020)

- The U.S. Small Business Administration (SBA) in consultation with the Treasury Department, released a simpler loan forgiveness application for Paycheck Protection Program (PPP) loans of $50,000 or less. This action streamlines the PPP forgiveness process to provide financial and administrative relief to America’s smallest businesses, including many hotels, while also ensuring sound stewardship of taxpayer dollars. SBA and Treasury have also eased the burden on PPP lenders, allowing lenders to process forgiveness applications more swiftly.

SBA began approving PPP forgiveness applications and remitting forgiveness payments to PPP lenders for PPP borrowers on October 2, 2020. SBA will continue to process all PPP forgiveness applications in an expeditious manner. (10/18/2020)- View the simpler loan forgiveness application

- View the instructions for completing the simpler loan forgiveness application

- View the Interim Final Rule on the simpler forgiveness process for loans of $50,000 or less.

- GHLA and AHLA applaud U.S. Senators Catherine Cortez Masto (D-N.V.) and Kevin Cramer (R-N.D.), who introduced new bipartisan legislation today to provide comprehensive relief and recovery measures for the convention, trade show, entertainment, travel and hospitality industries and their workers. The Hospitality and Commerce Job Recovery Act of 2020 would stimulate the economy by creating new recovery incentives for hospitality including meetings and trade shows, enhance the employee retention tax credit to help maintain worker connections to their employer, and provide recovery incentives for families to jumpstart travel when safe. (10/15/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (10/15/2020)

- Representatives Ted Budd (R-N.C.) and Lou Correa (D-Calif.) introduced the Online Accessibility Act, bipartisan legislation that would establish a website and mobile application accessibility standard to meet the general accessibility requirements under the Americans with Disabilities Act (ADA). Under the legislation, businesses would have 90 days to correct a violation before a complaint can move forward to the Department of Justice for investigation. GHLA and AHLA supports the legislation, which will provide much needed clarity and guidance to hoteliers and give them a roadmap to ensure their websites and mobile applications are accessible and welcoming. (10/08/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" The new rules allow restaurant and bar employees to return to work after 24 hours if they’re confirmed to be symptom free after they were confirmed or suspected of contracting COVID-19. Previous rules required them to stay away for three days. (9/30/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (9/15/2020)

- Governor Kemp issues updated Executive Order "Providing Additional Guidance for Empowering a Healthy Georgia in Response to COVID-19" (8/31/2020)

- Shelter in place remains in effect (higher risk of severe illness, those in LTC facilities, those with lung disease, etc).

- Restaurant / Event & Banquet Facility guidelines begin on page 13.

- Measures for non-critical infrastructure begin on page 16.

- Bar guidelines are on page 21 (limiting total number of patrons to fifty or thirty-five percent of total fire capacity occupancy, whichever is greater).

- Local face mask language begins on page 38.

- Sports/live performance venues are on page 40-45 — they are broken out into tiers based on capacity.

- Conventions are on page 45.

- The American Hotel & Lodging Association (AHLA) today released an analysis on the economic and human struggle of the hotel industry six months into the COVID-19 pandemic, with millions of employees still furloughed or laid off and travel demand lagging far behind normal levels. (8/31/2020)

- AHLA commissioned a new national survey conducted by Morning Consult to understand what frequent travelers want and expect with regards to hotel cleaning. Cleanliness is the most important factor when determining their next hotel stay, and 81% are more comfortable staying at hotels now that enhanced protocols and standards have been implemented. (8/27/2020)

- As part of the Let’s Go There coalition, we are sharing the Let's Go There toolkit, which includes resources to support the campaign on your channels. We encourage you to post, share and distribute far and wide. (8/27/2020)

- To better underscore how devasting COVID-19 has been on our industry over these many months, AHLA worked with commercial real estate data analyst group Trepp, on a new national report, showing the historic wave of foreclosures many in the industry are now facing as the pandemic continues to devastate small business hotel owners and its workforce. (8/20/2020)

- Updated Safe Stay Guidelines: The health and safety of our guests and employees remains the top priority for our industry. In keeping with this commitment, the evolving AHLA Safe Stay Guidelines remain an important tool in supporting our industry. (8/18/2020)

- The General Services Administration (GSA) released the FY2021 per diem rates for government travel in the Continental United States (CONUS) which reflect pre-COVID-19 rates. The move to hold per diem rates is a big victory for the hospitality industry. (8/14/2020)

- Georgia Safety Promise Reaches More than 1,000 Commitments - Statewide initiative for a ‘healthy Georgia’ gains momentum as participant numbers continue to grow (8/14/2020)

- President Donald Trump signed four executive orders over the weekend following a breakdown in negotiations between Congress and the Administration to provide additional aid to people struggling during the COVID-19 pandemic. Most notably, the action extends unemployment benefits through the end of the year, which goes from $600/week to $400/week. (8/11/2020)

- Recently, Representatives Van Taylor (R-TX), Al Lawson (D-FL), and Andy Barr (R-KY) introduced bipartisan legislation, The Helping Open Properties Endeavor (HOPE) Act (H.R. 7809). This legislation would provide borrowers of commercial mortgages with financial assistance through the HOPE Preferred Equity lending facility. The bill would help prevent commercial real estate foreclosures and protect jobs in the hospitality industry. (8/11/2020)

- Congressional negotiations have seemingly reached an impasse. However, our industry got a big victory in Georgia but we are concerned with legislation in Nevada. We continue tracking the slow recovery around rehiring and employment for the hospitality industry reminding everyone that we need to work together to Save Hotel Jobs! (8/7/2020)

- On August 5, 2020, Governor Brian P. Kemp took final action on several legislative measures, also issuing veto statements for four bills and a separate signing statement for House Bill 105. Read the Governor's statements here. (8/5/2020)

- Additional PPP Guidance Released: The Small Business Administration (SBA) and the Treasury Department today released additional Paycheck Protection Program (PPP) FAQs focused on PPP loan forgiveness. This document provides further details on the loan forgiveness process, required documentation, cost eligibility, and forgiveness amount calculations. AHLA will continue to work the Administration and Congress to ensure that the PPP and other pandemic economic relief options meet the needs of the hotel industry. (8/4/2020)

- Recovery Sector Loan Program: AHLA joined a joint trade association letter, led by the Economic Innovation Group, on modifications to the Recovery Sector Loan program proposed in the Health, Economic Assistance, Liability Protection and Schools (HEALS) Act. The Recovery Sector Loan program would modify the SBA’s existing 7(a) loan program to include 20-year, one percent interest loans to small businesses with at least a 50 percent reduction in revenue due to the COVID-19 pandemic. Unfortunately, the Recovery Sector Loan program includes several narrowly-defined eligibility requirements that will exclude numerous businesses from this much-needed program. In the letter, we applaud Congress for including this important provision but urge members to make the necessary changes for more businesses to take advantage of this program. (8/4/2020)

- Senate Banking Committee Chairman Mike Crapo (R-ID) sent a letter to Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell last Friday urging a quick expansion of the Main Street Lending Program (MSLP) by setting up an asset-based lending program and commercial real estate program. Chairman Crapo specifically focused on two items for the Treasury and Fed to consider: (8/3/2020)

- Establishing a facility to accommodate asset-based lending could open access to critical resources for several industries that could not otherwise access the MSLP based on earnings or cash flow metrics. Such asset-based lending would be predicated on pledged collateral.

- Addressing the unique circumstances faced by commercial real estate, including securitized commercial mortgages, whether through access in the MSLP or a separate facility. Several options have been circulated and should be carefully considered in crafting the appropriate terms.

- AHLA, along with hundreds of other businesses, trade associations and chambers of commerce recently sent a letter to Members of Congress in support of S.4317, the Safe to Work Act. This legislation would provide targeted and temporary liability protections to hotels. Any hotel that reopens and follows proper public health guidance to protect employees and guests should be afforded a limited safe harbor from exposure liability related to COVID-19. (8/2/2020)

- Housekeeping Frequency During a Safe Stay highlights guidance that discourages daily room cleaning to lessen exposure risks. (7/31/2020)

- Congress continues to slowly negotiate the next relief package with discussions between the Administration and Democrats producing little results this week. With so much daylight between the House Democrats' $3 Trillion HEROES Act and the Senate Republicans' $1 Trillion HEALS Act, it is hard to see a clear path forward. Nevertheless, many of AHLA’s priorities are included in both pieces of legislation and it is critical that we continue to advocate on both sides of the aisle. (7/30/2020)

- Bipartisan HOPE Act introduced: Today, U.S. Congressmen and members of the House Committee on Financial Services, Van Taylor (R-TX-03), Al Lawson (D-FL-05), and Andy Barr (R-KY-06), introduced legislation in the House of Representatives to provide economic support to the commercial real estate (CRE) market, especially for businesses with Commercial Mortgage-Backed Securities (CMBS) debt, and the millions of Americans they employ. H.R. 7809, the Helping Open Properties Endeavor (HOPE) Act works to protect millions of jobs by preventing Commercial Real Estate (CRE) foreclosures, specifically to borrowers of commercial mortgages by providing financial assistance through the HOPE Preferred Equity lending facility. Guaranteed by the Department of the Treasury, financial institutions will originate preferred equity instruments to borrowers. (7/29/2020)

- Senate and House pass the historic Coronavirus Aid, Relief and Economic Security Act, or CARES Act, sending the $2 trillion economic stimulus bill to the President's desk to sign into law. The bill includes: $349 billion in small business loans; expanded unemployment insurance, tax rebates and business tax provisions; funding for hospitals, healthcare facilities and providers; funding for impacted industries, including hotels. Summaries of the three bills to be passed are available online, along with an in-depth summary document of the CARES Act.

- HEALS Act Components: Following yesterday’s Senate Republican proposal for the next round of coronavirus relief – the “Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act” – more information is now available on each of the 8 proposals in the package. As a reminder, the House introduced the HEROES Act proposal in May, which passed along party lines. Discussions are expected to now begin in earnest as Congress faces the July 31 deadline for enhanced pandemic unemployment insurance benefits. Part of the Republican proposal would reduce these benefits from $600 per week to $200 per week on top of state administered aid until the end of September at which time the maximum benefit will be 70% of the recipient current wages -- but this will be a starting point for the negotiations. (7/28/2020)

- Senate Releases HEALS Act (Health Care Economic Assistance Liability Protection and Schools Act): Monday afternoon, Senate leadership released their long-awaited COVID 4 recovery package proposal. While this is considered a starting point for the negotiations, AHLA is encouraged to see many of AHLA’s industry priorities included in the package released today. (7/27/2020)

- GHLA Hosts GHLA Lodging Update (Government and Safety Edition) Earlier this month, more than 200 attended GHLA's Lodging Update webinar. The program served as a high-level overview of the Georgia Legislative Session, current issues in Congress, AHLA activities, and provided an opportunity to meet Georgia's new Deputy Commissioner of Tourism. A copy of the PowerPoint for GHLA's July 2020 Lodging Update is available for download. (7/27/2020)

- Robert Woolridge, GHLA's Board Chairman, opened the meeting. Woolridge outlined the work of GHLA's team throughout the legislative session and the COVID-19 pandemic to protect the business interest of members. Over the past few months, GHLA's team has worked with the Georgia Department of Labor Commissioner to clarify unemployment benefits for members and stayed in constant touch on the state's Executive Orders to ensure that hotels were classified as essential businesses with as much freedom to conduct business as safely as possible. The Association staff and GHLA's Executive Committee have taken necessary actions to ensure the Association will continue serving you and the industry now and in the future. Your continued membership and support of the GHLA is greatly appreciated.

- Representative Brett Harrell, Chair of Ways and Means, joined the program. He is a strong supporter of the hospitality and lodging industry. Rep. Harrell provided his insider's view of the top industry issues via a discussion with Jay Morgan, GHLA's Chief Lobbyist.

- Chris Hardman, GHLA's Director of Governmental Affairs, provided an in-depth report on the critical issues covered by your GHLA team during the session. Hardman condensed the overview into four areas: alcohol, social issues, short-term rentals and Safe Harbor. A detailed written overview is available for download.

- Mark Jaronski, Georgia's new Deputy Commissioner of the tourism division at the Georgia Department of Economic Development, was introduced to the industry on his fifth day on the job. He oversees the state's official DMO, Explore Georgia. Jaronski is a 26-year travel and tourism industry leader who has worked on iconic travel brands and destinations as a veteran of The Walt Disney Company and Visit Orlando. He encouraged everyone to sign on to the Georgia Safety Promise, a program designed to inspire consumer confidence to travel. Visitor Information Centers are beginning to reopen on the highways with PPE equipment installed and in use. A four-week campaign to "Explore Your Georgia" will begin late July in an effort to increase leisure travel.

- Chip Rogers, AHLA CEO, closed out the program highlighting the advocacy efforts at Congress for the industry. AHLA has been highly successful in ensuring our industry's voice is heard in Congress and by media.

- Georgia Safety Promise: As part of Governor Kemp's COVID-19 Task Force, GHLA pushed for the development of a program to enhance consumer confidence for business. The result of that Task Force was the creation of the Georgia Safety Promise. (7/25/2020)

- House Introduces Small Business Proposal: Representatives Filemon Vela (D-TX) and Lance Gooden (R-TX) have introduced H.R. 7671, the Small Business Comeback Act. This bipartisan legislation would establish a federal grant program to assist small businesses with operational expenses so that they may continue to reopen and remain open. By offsetting operational expenditures, businesses will be able to rehire, retain, and provide support for their valued employees. This legislation directs the Secretary of Treasury to appoint a special Administrator to operate a streamlined relief fund that provides nearly instant decisions on loan approvals and quickly distributes funds to businesses that desperately need support. Financial assistance can be used for expenses such as rent, utilities, payroll, and state and local taxes. (7/21/2020)

- AHLA has united the industry around the announcement of the “Safe Stay Guest Checklist,” a list for guests on how to travel safely, including the required use of face coverings in all indoor public spaces. This checklist is part of AHLA’s Safe Stay guidelines, an industry-wide, enhanced set of health and safety protocols designed to provide a safe and clean environment for all hotel guests and employees. (7/17/2020)

- Small Business Administration (SBA) Closes Aid Program: The SBA announced this weekend that it ended its Economic Injury Disaster Loan (EIDL) Advance program after exhausting $20 billion in funding. While businesses can still apply for EIDL loans, application processing faced delays and unexpected limits on how much support businesses could seek. (7/14/2020)

- Paycheck Protection Program (PPP) Loan Data Released: The Small Business Administration (SBA) and Department of Treasury released detailed loan-level data related to the 4.9 million loans provided under the PPP which was passed by Congress in the CARES Act in March of this year. The data is available here. (7/7/2020)

- AHLA officially endorsed the Timely and Effective Systematic Testing (TEST) Act, which was introduced last week by Senators Cory Gardner (R-CO), Michael Bennet (D-CO), Mitt Romney (R-UT), and Kyrsten Sinema (D-AZ). The legislation is designed to create a modernized, focused approach to testing, making it easier and safer for Americans to begin traveling and staying in hotels again. AHLA believes that increased testing is a critical component to regaining consumer confidence and regaining lost demand due to COVID-19. (7/7/2020)

- House Passes Paycheck Protection Program (PPP) Extension: The House of Representatives passed an extension of the PPP lending deadline from June 30 to August 8. The Senate passed the extension by Unanimous Consent earlier this week and President Trump is expected to sign the legislation soon. This will revive the $610 billion small business aid program and make the remaining funds available for additional applications. (7/2/2020)

- Senator Martha McSally (R-AZ) introduced The American Trip Act, which includes the following highlights: (6/22/2020)

- Provides a $4,000 travel credit for individuals, and $8,000 for joint filers (plus an additional $500 credit for dependent children), for 2020, 2021, and 2022

- Applies to all travel within the United States and its territories, so long as the travel and expenses and final destination is 50 miles from the principal residence of the filer(s)

- Qualified expenses for the credit include lodging, travel, and entertainment

- Explore Georgia, the state’s tourism division, is actively working with travel partners to assess current needs and assist in recovery strategies. To read more about how the Explore Georgia brand is responding to COVID-19, click here. Explore Georgia’s Travel Alert page is also an excellent resource for travel-related information and is updated regularly. Several of our Visitor Information Centers began safely reopening on June 20 as part of a phased test.(6/20/2020)

- On May 22, the Georgia Film Office released a “best practices” guide for production companies to consider as they make plans to resume operations is available here. On June 20, Film Office Director Lee Thomas provided a status report through a new blog post available here. For more about how the industry is helping in the fight against COVID-19, check out our post, “Spotlight on Georgia Film Industry Efforts to Help During COVID-19.” (6/20/2020)

- Congressional Commercial Real Estate Relief Letter: AHLA continues to request swift action by the U.S. Treasury and the Federal Reserve to help thousands of small business hotel owners who are struggling to make debt service payments on their mortgages, including commercial mortgage-backed securities (CMBS) debt to keep their doors open and avoid foreclosure. We are urging them to provide desperately needed relief to the commercial real estate market, including hotels. Reps. Taylor, Heck, Barr and Lawson are leading this Congressional effort and their letter can be found here. Without action to shore up debt servicing, including in the CMBS market, this crisis will lead to widespread foreclosures, snowballing into mass disruption and a critical lack of liquidity in the commercial real estate market. (6/18/2020)

- New and Revised Paycheck Protection Program (PPP) Applications Available: The Small Business Administration (SBA), along with the Department of the Treasury, announced a revised, borrower-friendly PPP loan forgiveness application based on updates included through the PPP Flexibility Act (PPPFA). A new EZ version of the application is also available for borrowers that are self-employed or did not reduce salaries of employees by more than 25%. More information is available and the applications are available here: (6/17/2020)

- Economic Injury Disaster Loan (EIDL) Program Reopens for Hotels: AHLA applauds the Small Business Administration (SBA)'s reopening of the EIDL and EIDL Advance program portal yesterday to non-agriculture industries, including hotels. This opens another avenue of necessary economic relief for hoteliers managing the ongoing impacts of COVID-19 on their business. (6/16/2020)

- Main Street Lending Program Live: The Federal Reserve announced that the Main Street Lending Program is now open for lender registration. Fed Chairman Powell indicated today during the Senate Banking Committee hearing that lender approvals would begin imminently and that once approved, lenders could begin lending through the program. Interested borrowers are encouraged to contact their lenders to determine if the lender is participating and if the borrower would qualify. More information can be found here. (6/15/2020)

- New PPP Guidance and Applications Released: The Small Business Administration (SBA), in consultation with the Department of Treasury, released additional PPP guidance based on revisions within the Paycheck Protection Program Flexibility Act (PPPFA), which was signed into law. Thanks to your efforts, the PPPFA was a direct result of AHLA's leadership and your grassroots engagement. Almost the entire list of priorities advanced by AHLA were adopted in the bill that passed. AHLA's one-page guide highlights the differences between the PPP and PPPFA. The newly released guidance from the SBA and Treasury includes updated provisions regarding loan maturity, deferral of loan payments, and forgiveness provisions. A revised PPP application reflecting these updates is now available. (6/15/2020)

- Hearing with Treasury and SBA on Small Business Loans: The Senate Small Business Committee held a hearing with Treasury Secretary Steven Mnuchin and SBA Administrator Jovita Carranza on Title 1 of the CARES Act -- Keeping American workers paid and employed Act: SBA Loan Program. Secretary Mnuchin repeatedly called for additional legislation to provide aid to the economy and to severely impacted industries, specifically citing travel and hospitality. He expressed support for heavily affected sectors accessing additional PPP funds, assuming bipartisan support for the measure and stated that a simplified forgiveness form and further guidance based on the recently passed Paycheck Protection Program Flexibility Act were forthcoming. A bill allowing businesses who have already expended a PPP loan to apply for a second one, if they can demonstrate a revenue loss of 50 percent+ and have 100 or fewer employees, is currently being considered for introduction by Senator Ben Cardin (D-MD), Chris Coons (D-DE), and Jeanne Shaheen (D-NH). (6/10/2020)

- U.S. Department of Treasury and SBA Issue Joint Statement: SBA Administrator Jovita Carranza and U.S. Treasury Secretary Steven Mnuchin issued a statement committing to issuing prompt rules and guidance, a modified borrower application form, and a modified loan forgiveness application implementing the legislative amendments to the PPP. (6/8/2020)

- President Donald Trump signed H.R. 7010, Paycheck Protection Program Flexibility Act of 2020 into law today. Upon signing President Trump noted that hotels sorely needed these enhanced measures: "I am going to sign legislation to make important changes to the PPP that will especially help restaurants, hotels, and other businesses that have them very hard hit by the virus." (6/5/2020)

- AHLA joined a letter with leading associations throughout the business community in support of the Clean Start: Back to Work Tax Credit introduced by Representatives Darin LaHood (R-IL) and Stephanie Murphy (D-FL). This legislation creates temporary tax credit per business entity to help cover the unanticipated and increased cleaning costs associated with fighting the coronavirus. (6/1/2020)

- Carolyn Maloney, Chairwoman of Oversight and Government Reform, has introduced H.R. 7011, the Pandemic Risk Insurance Act of 2020 (PRIA). This legislation would create the Pandemic Risk Reinsurance Program, a system of shared public and private compensation for business interruption losses resulting from future pandemics or public health emergencies. Like the Terrorism Risk Insurance Act (TRIA), the federal government would serve as a backstop to maintain marketplace stability and share the burden alongside private industry. (5/27/2020)

- AHLA expressed support today for H.R. 6995, bipartisan legislation introduced by Representatives Bill Posey (R-FL) and Charlie Crist (D-FL) to preserve federal per diem rates from being set below a certain level. General Services Administration (GSA) rates will be adversely impacted through 2022 and beyond due to the severe drop in hotel room rates and occupancy resulting from the COVID-19 crisis which brought travel to a virtual halt. (5/26/2020)

- The Department of Treasury and the Small Business Administration issued their long awaited guidance on PPP Loan Forgiveness. An "interim final rule" (IFR) was released to allow some flexibility on a go forward basis under the assumption that Congress will ultimately change the PPP through statute, which could come as early as next week. This guidance explains how PPP borrowers can apply for loan forgiveness (Page 7 of the IFR). Essentially, each borrower must fill out a separate application form (SBA FORM 3508) and submit it to their lender who will then transmit the loan forgiveness application to the SBA.The SBA Form 3508 walks the borrower through how to calculate their loan forgiveness amount and what costs that are eligible for forgiveness (which includes the 75/25 ratio – see bottom of page 2 of SBA Form 3508). (5/22/2020)

- Interim Final Rule on SBA Loan Review Procedures and Related Borrower and Lender Responsibilities (5/22/20)

- Lender Processing Fee Payment and 1502 Reporting Process (Effective 5/21/20)

- Interim Final Rule on Second Extension of Limited Safe Harbor with Respect to Certification Concerning Need for PPP Loan and Lender Reporting (5/20/20)

- FAQ (Last Updated 5/19/20)

- Congressman Chip Roy (R TX-21) and Congressman Dean Phillips (D MN-03) introduced the Paycheck Protection Flexibility Act (HR. 6886) . (5/22/2020)

- Senators Marco Rubio (R-FL), Ben Cardin (D-MD), Susan Collins (R-ME), and Jeanne Shaheen (D-NH), who were the lead architects of PPP in the CARES Act, have introduced the Paycheck Protection Program Extension Act (S.3883). While the legislation contains several key provisions to extend loan forgiveness and the covered period, it received some opposition from both sides with many wanting more changes to the program and it was unable to pass by Unanimous Consent. Additionally, Senators Angus King (D-ME), Steve Daines (R-MT), Debbie Stabenow (D-MI), Thom Tillis (R-NC), Tim Kaine (D-VA), and Cory Gardner (R-CO), introduced the companion bill to the Paycheck Protection Flexibility Act in the Senate. Senate Majority Leader Mitch McConnell has already signaled a willingness to press for a vote for the PPP Extension Act when the Senate returns the first week of June. The House is set to press forward on a vote next week on the bipartisan-supported Paycheck Protection Flexibility Act. (5/21/2020)

- AHLA released a "Roadmap to Recovery" today, calling on Congress to prioritize relief for hotel workers and small businesses in the next stimulus package. Along with new data from the Bureau of Labor Statistics (BLS) showing staggering job loss to the hospitality and leisure industry, the April Jobs Report showed the hospitality and leisure industry was the hardest hit, losing 7.7 million jobs—nearly as many jobs as the next four sectors combined. With a presence in every congressional district in America, hotels are central to getting our economy back on track and supporting millions of jobs. Prior to the pandemic, hotels were proud to support one in 25 American jobs—8.3 million in total—and contribute $660 billion to U.S. GDP. The full Roadmap to Recovery and corresponding infographic are now available. (5/20/2020)

- PPP Loan Forgiveness Application: The SBA, in consultation with Treasury, has released the PPP Loan Forgiveness Application. The SBA will also issue further regulations and guidance for borrowers, as well as for lender responsibility. The application and instructions can be found here. (5/18/2020)

- The House passed the $3 trillion HEROES Act: Senate Majority Leader Mitch McConnell is not expected to consider the bill voted on by the House of Representatives in its current form. (5/18/2020)

- The Treasury released a new FAQ about the PPP auditing process. Specifically, question #46 relates to safe harbor as it pertains to SBA's review of PPP loans. Senator Marco Rubio (R-FL) also shared his comments on PPP flexibility as it pertains to the 75% rule and the 8 week deadline. He encouraged legislation to be passed around PPP enhancements and flexibility in regards to this deadline. (5/15/2020)

- The introduction of the HEROES Act by House Democrats yesterday proposes a massive $3 trillion package, including important changes to the Paycheck Protection Program (PPP) that AHLA and the hotel industry have been encouraging since the PPP was enacted. AHLA released a statement today expressing support for elements of the HEROES Act. The House is expected to vote on the HEROES Act this Friday with an expectation for the vote to fall largely along party lines. Once the bill reaches the Senate floor, Majority Leader Mitch McConnell is not expected to consider the bill in its current form. AHLA expects that formal House-Senate negotiations will likely go late into May or early June and we will continue advocating for our industry priorities to ensure they are included in upcoming negotiations. (5/12/2020)

- House Leadership has released the next legislative package in response to the Coronavirus. H.R. 6800 – The HEROES Act is expected to be considered by the full House of Representatives as early as Friday. An overview of the bill can be found HERE. (5/11/2020)

- AHLA spearheaded an effort to enlist more than 100 organizations in sending a letter to Congressional Leaders today supporting efforts to create targeted and limited safe harbor from liability provisions related to the transmission of COVID-19. AHLA will continue to work with our partners in Congress to ensure any discussions surrounding limited liability protections include the hotel industry's concerns. (5/11/2020)

- in Congress, discussions around limited liability protections for businesses preparing to reopen will be front and center next Tuesday as Senate Judiciary Committee Chairman Lindsey Graham will hold a hearing titled, "Examining Liability During the COVID-19 Pandemic." (5/8/2020)

- The Treasury and SBA provided additional guidance to address borrower and lender questions concerning the implementation of the Paycheck Protection Program (PPP). Of interest, question 40 in the updated FAQ provides clarification on employee rehiring and states that any employee who is offered a chance to return and does not do so, will not count against the forgiveness calculations. This article provides a helpful overview. SBA and Treasury intend to issue an interim final rule excluding laid-off employees whom the borrower offered to rehire from the CARES Act's loan forgiveness reduction calculation. (5/5/2020)

- The DOL issued additional guidance regarding eligibility of furloughed employees to receive regular unemployment or enhanced pandemic unemployment assistance (PUA) once their employer reopens for business and offers to rehire the employee. There continues to be concerns on the Hill about DOL's ability to enforce these guidelines and that additional statutory language will likely be necessary to address ongoing rehiring concerns. (5/5/2020)

- The Federal Reserve gave an update on its monetary policy efforts announcing that their current interest rate guidance and existing policy actions would continue. They provided additional details on the Main Street Lending Facility (MSLF) and Chairman Jerome Powell committed to using the Fed's full range of tools to support the economy until a recovery is well underway. Chairman Powell touched on the Fed's lending facilities – specifically, the Corporate Credit Facility (CCF) and MSLF – but did not provide a concrete date for either launch. He announced that the CCF is near being finalized and will be operating soon and that the MSLF received thousands of comments on the proposed term sheet. The newly announced details of the MSLF indicated a broadening of the program through multiple lending products to include both even larger businesses than previously, as well as smaller and more highly levered businesses. The maximum number of employees was increased as were both the maximum and minimum loan amounts. Details can be found on federalreserve.gov. Powell's commentary on the MSLF indicated that they are considering the possibility of targeting specific sectors. He also indicated a likely phased approach for expansion of the program to include those specifics. In contrast with PPP, Chairman Powell discussed how the Fed is committed to fund the MSLF and CCF to the extent necessary based on demand. (4/30/2020)

- The IRS released new FAQs regarding Employee Retention Credit under the CARES Act. AHLA has compiled this information into a guidance document, which is now available online. (4/30/2020)

- The safety of our employees and our guests is the number one priority of the hotel industry. That's why AHLA today launched "Safe Stay," an initiative focused on enhanced hotel cleaning practices, social interactions, and workplace protocols to meet the new health and safety challenges and expectations presented by COVID-19. As the country begins discussing reopening efforts, AHLA convened the Safe Stay Advisory Council today to tackle the development of industry guidance to be broadly used and adopted by hotels around the country with the goal of providing assurances of safety and security to our employees and the traveling public. (4/27/2020)

- The Small Business Administration (SBA), in consultation with the Department of the Treasury, released a new FAQ with additional guidance to address borrower and lender questions concerning the implementation of the Paycheck Protection Program (PPP) and an Interim Final Rule on Requirements for Promissory Notes, Authorizations, Affiliation, and Eligibility. The newest FAQ addresses questions around businesses owned by large companies with adequate sources of liquidity to qualify for a PPP loan in order to support the business's ongoing operations. (4/24/2020)

- As reopening guidelines and initial plans begin to take shape, AHLA has launched the Reopening Guidance Tracker to assist hoteliers in digesting the phased-in reopening of economies that has begun across the country. As Governors and Mayors roll out their strategies for restarting business operations, this living document is intended to parse out the critical information needed for hoteliers as you prepare to welcome guests back to your properties. (4/24/2020)

- The U.S. Senate passed the Paycheck Protection Program and Enhancement Act Tuesday evening. The House of Representatives is set to vote on the $484 Billion package tomorrow. (4/22/2020)

- Department of Homeland Security’s (DHS) Cybersecurity and Infrastructure Security Agency (CISA) released version 3.0 of the Essential Critical Infrastructure Workers guidance. This guidance is to help state and local jurisdictions and the private sector identify and manage their essential workforce while responding to COVID-19. (4/17/2020)

- The Department of Treasury released a new Interim Final Rule on additional eligibility criteria and requirements for the SBA's Paycheck Protection Program (PPP). Additionally, updated FAQs were released which provide more insight on how our industry can access the program. We will continue to alert you as new information is released. (4/14/2020)

- Today, the Senate failed to pass competing COVID relief proposals via unanimous consent (UC), as both parties objected to the others proposal. Majority Leader Mitch McConnell proposed a straightforward, clean appropriation of an additional $250BN for the SBA PPP program. The Democrats presented another proposal. (4/10/2020)

- The Federal Reserve announced this morning specifics on the various lending facilities it is establishing via its 13(3) authority in the CARES Act to provide aid to small and mid-sized businesses as well as local governments. These loan programs will inject up to $2.3T of liquidity into the market. This announcement included details on the Main Street Lending Program, direct financing for institutions offering PPP loans and expansions of recently launched facilities, including the Term Asset-Backed Securities Loan Facility (TALF), as well as a new liquidity facility for state and local governments. Terms of the various programs are found at the bottom of the release and we anticipate additional guidance and FAQ's to be promulgated in the coming days. The Main Street Lending Program is targeted at businesses (up to 10,000 employees and $2.5B in revenue) too large to qualify for PPP loans, offering loans ranging from $1M to $150M totaling up to $600B for the program. The terms of these loans will restrict stock buybacks, dividends and executive compensation. Companies that have received separate forgivable PPP loans will still be eligible to seek Main Street loans as well.The TALF expansion makes, previously excluded, existing commercial mortgage-backed securities (CMBS) debt eligible collateral for the program, injecting much needed liquidity into a market with $86B worth of hotel debt. This liquidity and the price discovery that will come with it are a step in the right direction to support the CMBS market and allow servicers to assist hotel borrowers. (4/8/2020)

- The Department of Treasury has released the interim final rule for the SBA's Paycheck Protection Program (PPP) Loan. It's important to note that the applicability date is as follows: This interim final rule applies to applications submitted under the Paycheck Protection Program through June 30, 2020, or until funds made available for this purpose are exhausted. We strongly suggest you work with your SBA approved lender and apply for these loans as quickly as possible. The demand for these loans is significant and it is important to be in the queue. (4/3/2020)

- Small Business Administration (SBA) released its streamlined application for the Economic Injury Disaster Loan (EIDL). With this new online portal, participants may quickly identify whether they are eligible for disaster loan support. There is also increased funding for the disaster loan program. Learn more about how these loans can be utilized. (4/2/2020)

- The Treasury Department has released initial guidance for the SBA's Paycheck Protection Program (PPP). Eligible small businesses may begin applying for these loans TOMORROW, Friday, April 3, 2020. There is always the possibility the date may be extended. We will keep you updated. (4/2/2020)

- Click HERE for Paycheck Protection Program Overview & Information

- Click HERE for Lender Information

- Click HERE for Borrower information

- Click HERE for a loan application

- Alternative Care Site Resources: Should your hotel enter into an agreement with the local government to be an Alternative Care Site, the following resources may prove helpful: (4/1/2020)

- Updated State by State Unemployment Guidelines Due to COVID-19 (Fisher Phillips 4/6/20)

- Treasury/IRS Guidelines on Tax Credits for Paid Leave

- CBRE Research on Commercial Mortgage-Backed Securities (CMBS) (4/1/20)

- S. 3548 - Coronavirus Aid, Relief, and Economic Security Act Summary -- Read the AHLA Summary (3/26/20)

- H.R.6201 - Families First Coronavirus Response Act Summary -- Read the AHLA Summary (3/18/20)

- H.R. 6074 – Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 -- Read the AHLA Summary (3/6/20)

- Executive Actions on Hotels as “Essential Businesses” (3/27/20)

- Gov. Kemp and Georgia Dept. of Labor Extend Unemployment Benefits for Georgians (3/26/20)

- Georgia Administrative Order for Public Health Control Measures (3/23/20)

- Federal Hotel Leasing Program

- Important Employer Alert: COVID-19 & GA Unemployment (Kenneth N. Winkler, 3/18/20)

- Emergency Changes To Georgia Unemployment With Harsh Penalties For Employers In Response To COVID-19 (Fisher Phillips, 3/19/20)

- Gov. Kemp, Georgia Dept. of Labor Focus on Assisting Workers Affected by COVID-19 (3/18/20)

- The President’s Coronavirus Guidelines for America - 15 Days to Slow the Spread (3/16/20)